Howard Marks received so many questions regarding US inflation. The Federal Reserve interest rate will determine whether or not there will be a recession in the US.

Does the obvious fact that there will be a recession soon mean we have to reduce investments or adjust our portfolio allocations? “I don’t think it so,” he stated in his latest message. Howard Marks noted that we can’t predict the future and that consensus is not reliable. He noted that although there’s always the chance of an undesirable event or the fact that one might occur, this is not an indication to decrease risk. Instead, investors should be cautious if such an event is likely and isn’t adequately seen in asset price.

Howard Marks noted that even if someone has a view for a brief period of time, they can’t and shouldn’t have much faith in it. “If there is a consensus, there is nothing that we are not able to do it. Investors can’t and will not meaningfully change their portfolios. In his latest memo, he explained that traders and investors shouldn’t pay attention to the short term.

Superior results

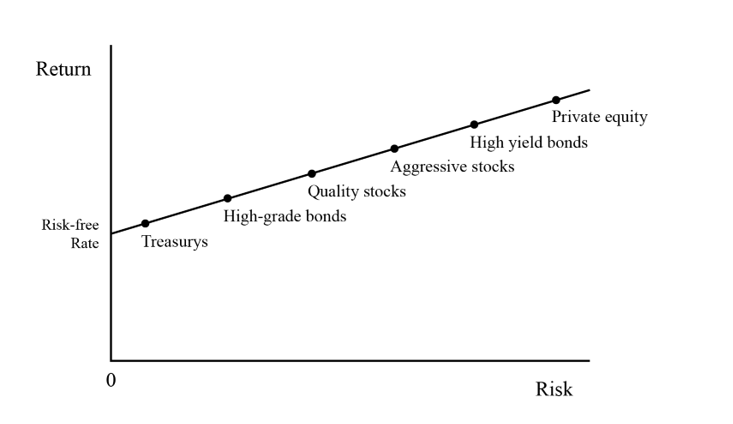

An investor must be able to go beyond the conventions of Howard Marks to attain higher returns than others. He pointed out that quantitative information about the current doesn’t necessarily indicate superior efficiency. While first-level analysts may look for simple formulas and solutions, second-level analysts know that achievement in investing can be the antithesis of easy. Howard Marks explained that in order to reap superior returns in a market, you must be overweight with certain securities, asset tracks, or markets.

The market consensus view of members is baked into the market costs, he stated. If an investor doesn’t have a perception superior to that of the others who make up the group, he should anticipate common risk-adjusted efficiency.

“If you are pleased doing average you can simply invest in large amounts of the assets you choose, buying as many of each as is necessary to represent it in the applicable index. Your performance will be average if you engage in average behavior.” Marks mentioned.

Marks pointed out that every live wager placed for the quest of above normal returns carries with them the risk of returns.

He explained that it was impossible to expect above-average returns for active betting if one doesn’t place them. But if they are wrong, you will get a lower return.”

Howard Marks noted that diverse buyers could be equally skilled, computer-literate, and highly knowledgeable. This means buyers must have an edge.

“You must be able to think and react differently. It is not sufficient to be right. Marks noted that you need to be additional correct than others.

He believes that excessive highs, lows, and miscalculations by buyers can lead to extreme results. In these cases, it is best to stand out.

“Every investor has the responsibility to decide which progression to take. You can pursue greater returns but run the risk to fall behind others, or you could embrace the consent position and have average performance,” he explained.

Temperament

Howard Marks suggested that having unconventional investment habits was the only way to get better results. However, it’s not for everyone. To be successful in investing, you must have the ability and willingness to make mistakes.

Think about time

Howard Marks noted that if you wait at a stopped bus for enough time, you are guaranteed to catch one. But, he ran from the bus stop bus cease to it and could not catch a ride on a bus.

“If everyone is focusing only on what doesn’t really matter and overlooking what does, investors can successfully differentiate from the others. This means that they can block out temporary concerns while keeping a laser-focused on lasting capital deployment,” he stated.